45l tax credit certification

Use this lookup to determine the amount youll receive for the homeowner tax rebate credit HTRC. Acquired by a person from such eligible contractor for use as a residence during the taxable year.

45l Tax Credit Services For Energy Efficient Homes Cheers 45l

Builders owners and developers of residential homes and apartment buildings have the opportunity to earn tax credits for energy efficiency if their.

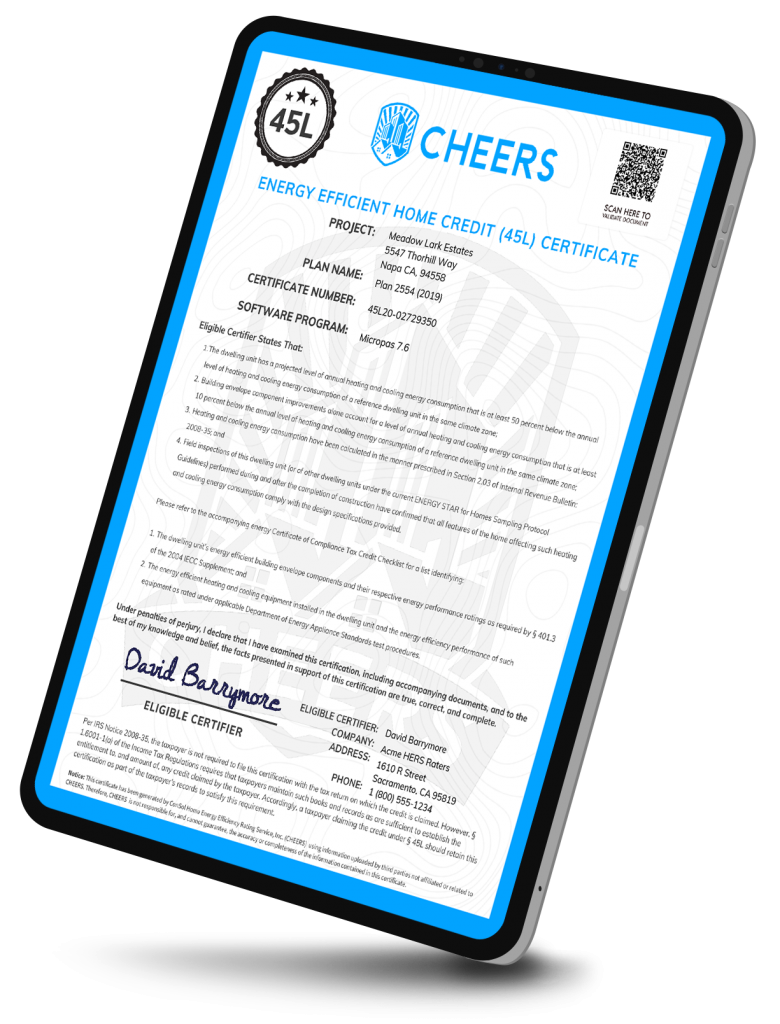

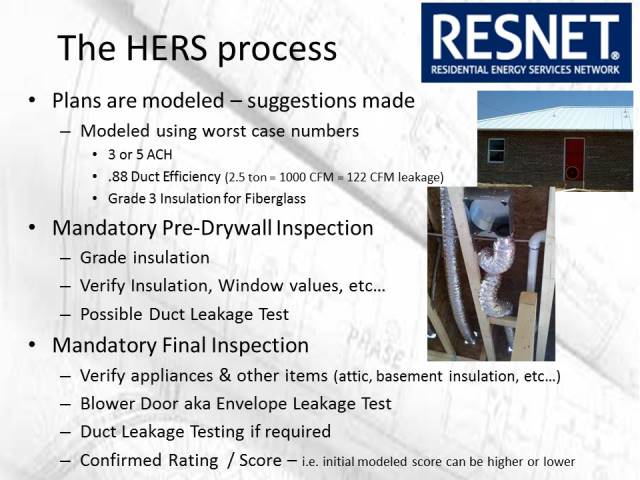

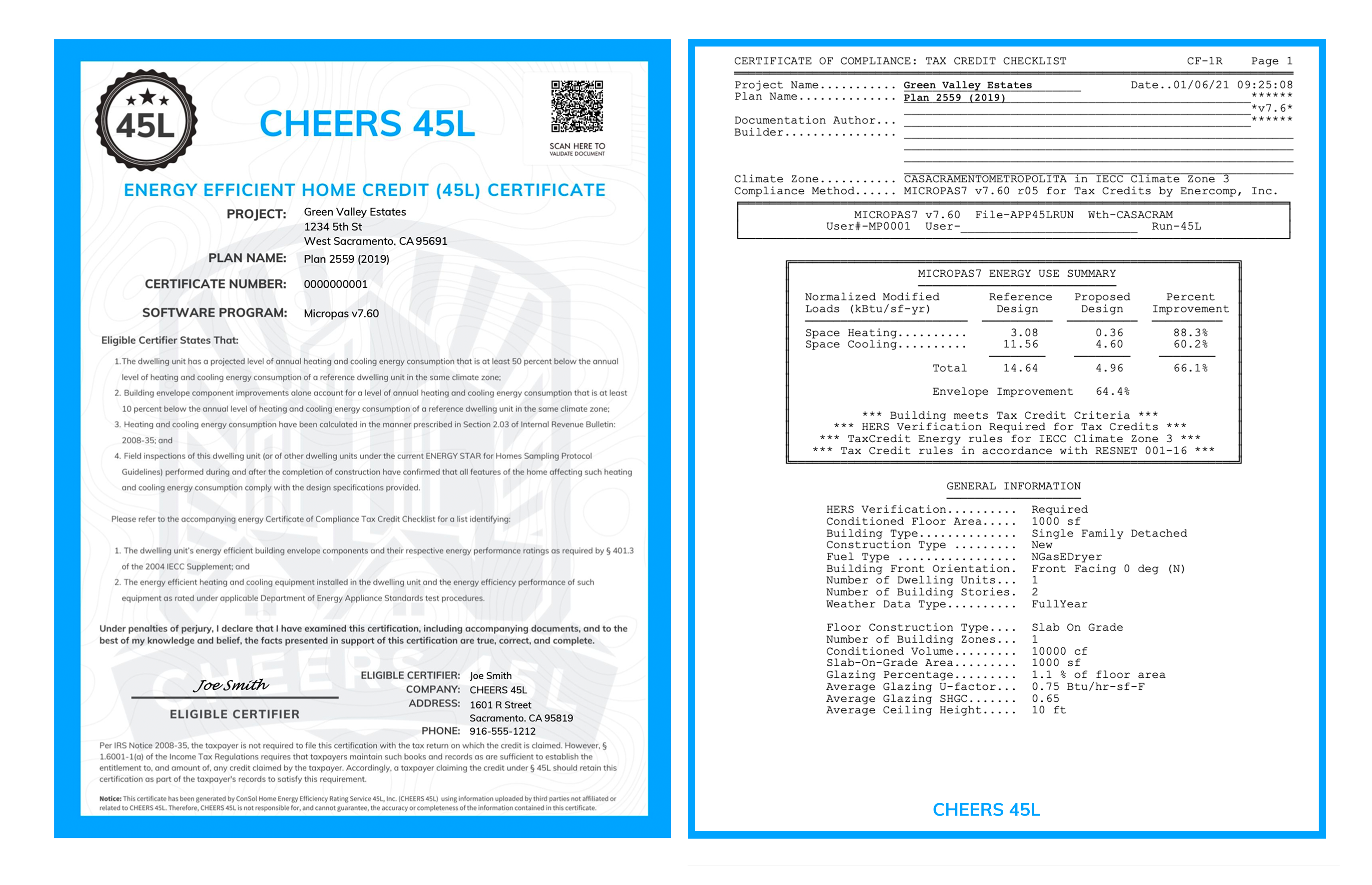

. For qualified new energy efficient homes other than manufactured homes. HERS Raters create and sign the 45L certificate as the Eligible Certifier. An eligible contractor must obtain a certification that the dwelling unit meets the requirements of section 45Lc from an eligible certifier before claiming the section 45L credit.

Assessors strive to provide property owners with fair and accurate assessments. Builders use this package as supporting documentation when claiming the 2000 tax credit. 2000 per qualified home Single family and multi-family projects up to.

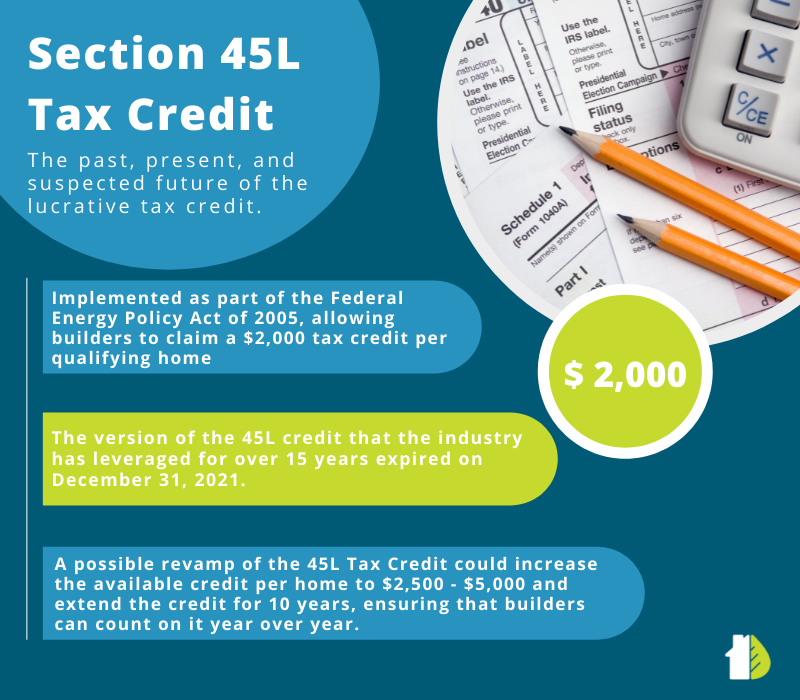

The 45L Tax Credit is a Federal Tax Credit worth 2000 per dwelling unit that rewards multifamily developers investors and homebuilders that develop energy efficient. Once your 45L certification is complete your will receive a full certification package that contains all the necessary certifications and documentation youll need to. The 45L Energy Efficient Home Credit offers builders developers a 2000 federal tax credit per energy efficient home.

In order to receive a PBC Certificate a conservation easement governing the future use of the parcel must be placed on the parcel and filed with the Suffolk County Clerk. WHO CAN CLAIM THE 45L TAX. Detailed energy analysis documents and reports can be provided including Energy Star certification.

If youre not sure you qualify for. The 45L Tax certificate. Weve already started mailing checks.

Section 45L provides a credit to an eligible contractor who constructs a qualified new energy efficient home. To estimate the market value of property the assessor must be familiar with the local real. The 45L credit is one of many benefits of the HERS rating.

The certificate holder can receive a 2000 tax credit per qualified single family home and multi-family unit built and sold before 01012022. 45L Energy Efficient Tax Credits. Code 45L - New energy efficient home credit.

The leader in 45L Tax Credit certification support service including EnergyPro 45L software Raters services and free 45L plan reviews.

Sell Your Home Pearl Certification

Energy Tax Credits Warner Robinson Llc

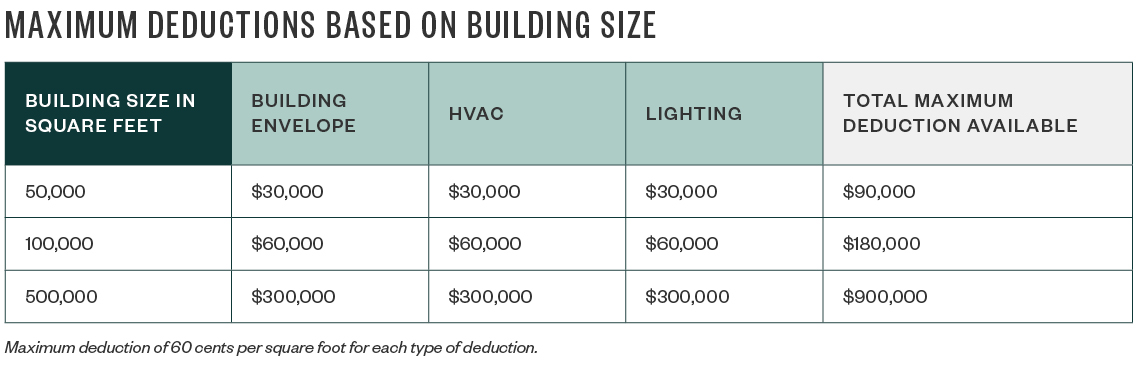

Tax Incentives For Energy Efficient Buildings

45l Tax Credit Services Using Doe Approved Software

45l Tax Credit Single Family Guide For More Money Back Southern Energy Management

Section 45l Tax Incentive For The Real Estate Industry Extended Through December 2020 Tax Point Advisors

45l Energy Efficient Tax Credits Engineered Tax Services

Section 45l Tax Credit Extended Through 2021 Wipfli

How Does The 45l Tax Credit Work Energy Diagnostic

Energy Tax Incentives Available For The Real Estate And Construction Industries Marks Paneth

Section 45l Energy Tax Credit Past Present And Future Ekotrope

45l Tax Credit Energy Efficient Home Credit For Developers Baker Tilly

45l Tax Credit Processing Skyetec

Tax Credits For Home Builders Energy Star

45l Energy Efficient Home Credit Ics Tax Llc

45l Tax Credit Energy Efficient Home Credit For Developers Baker Tilly

The 2 000 45l Efficiency Tax Credit What You Need To Know Attainable Home